Do Diamonds Appreciate? Understanding the Increase in Value of Diamonds Over Time

Diamonds have an interesting history of symbols as well as aesthetics for many centuries. Nevertheless, apart from the emotional importance attached to these stones, there is a more thumb-sucking question that comes into most investors' and non-investors' minds alike: do diamonds appreciate over several years? This particular article is written to look at the several economic aspects that affect the value of these precious stones on the market. It will ask the question, “Do diamonds make a good investment?” and consider what should matter to any buyer in terms of whether their value will go up. For collectors, investors, or readers interested in the subject, this article will bring all aspects to the forefront, providing an analysis of all facets involved in diamond value.

Introduction to Diamond Appreciation

The inclination of diamonds to appreciate in worth over time largely stems from principal concepts such as scarcity, grades, demand, supply, and economic development. Diamond materials that are of the required visual properties were tested for durability and light return, and those that met the standard requirements stand a higher chance of maintaining or increasing the value of the diamond material over a very long period of time. Moreover, naturally occurring diamonds are ever more scarce as the mining operations follow more prohibitive practices, thus contributing to their future rarity. The forces of the market in reference to the social meaning and how prospective customers perceive the value of the stones are another source of key concern. Diamonds can also be a long-term investment, but the degree to which they appreciate gold and reways does not come easily, unless the diamonds acquired are of the desired nature and originate from recognized bodies.

What Does it Mean for Diamonds to Appreciate in Value?

- Uniqueness and Refinement: Diamonds that have distinctive features, for example, rare colored sparklers (pink or blue, for instance) or of outstanding clarity and craftsmanship that is cut in an excellent way, have an increased potential for appreciation.

- Demand in the Market: How much a diamond appreciates in value is mostly dictated by how the market varies with demand, more often than not as a result of fads, where certain goods represent some cultural significance, as well as other socio-economic conditions influencing how individuals buy.

- Grade and Origins: The diamonds that come with certification from reputable bodies, for instance, such as the Gemological Institute of America (GIA) and Origin, which have been checked and authenticated, help in lively retention of value or higher value since perception concerns of credibility and publicity are addressed.

Importance of Diamond Resale Value for Investors

The primary objective of a long-term diamond investor is to make a good return on that investment, depending on the resale value. The higher it is, the easier it is to convert diamonds into cash in a competitive market; thus, how much individuals or companies holding diamonds can spend varies. Resale value varies depending on factors such as quality, certification, demand in the market, and the prevailing economic conditions. Prospective buyers are attracted to certified diamonds with a clear and trusted origin as much as possible, which is why the oval shape has a resale advantage. It is important for investors to invest in diamonds, which are likely to appreciate in the future as well as offer good care for long-term maximization of the value.

Why Understanding Diamond Value is Crucial

- Helpful Information in One Place: Knowing how to value diamonds also helps buyers distinguish genuine value from a high price. It provides them with the details to look for, like a cut, clarity, colour, and carat, thereby assisting them in making wise and prudent purchases of items within specified budgets and expectations.

- Availability of Profits through Investment: Some people view diamonds as an offshore safe haven, and their valuations, which are understood, help the investors decide which pieces they think will be more valuable in time. There is a need for such knowledge in terms of interpreting the adherence of such products to growth lines, the issuer’s bad quality, and selling the item at the set prices.

- Maintaining Value in the Long-Term: To be able to keep a diamond in its condition and balance its beauty, one must know how to take care of and treat it correctly. Knowing what makes a diamond lose its sharpness or break, or keeping it in the wrong place, can help decide precautionary actions that could help preserve the stone either monetarily or for emotional purposes in the near future.

Factors Influencing Diamond Value Over Time

Supply and Demand Dynamics in the Diamond Market

It goes without saying that demand and supply have a big weight when it comes to the value of a commodity such as diamonds. On the demand end, people will look at aspects like taste and preference of the consumers, world economic forces, cultural forces, how they fit, and lastly, the demand for the commodity: diamonds, in this case, most of the time due to jewelry. In periods of economic improvement, there is generally a rise in the demand for diamonds, while there is a decline in the demand during economic recessions. Usually, when diamond prices remain stable, it’s because, most commonly, there is a limitation on the availability of diamonds, and it’s accompanied by a reasonable level of demand. Such changes in either the availability or demand of diamonds are, however, not without consequences on the market. To explain the importance of such a provision, it would be worth asking why and under what circumstances diamonds appreciate and depreciate.

Global Economic Conditions Impacting Diamond Prices

The state of the global economy has a direct bearing on the price of diamonds, in relation to the consumers' ability to buy as well as their demand for them. Economic expansion is, on the contrary, consistent with the increase in income, which enhances consumption, particularly on premium goods such as diamonds, thus increasing the demand and therefore prices. On the other hand, when the economy crumbles, people are not optimistic about spending; therefore, the demand reduces, causing the prices to decrease. Moreover, exchange rates may undermine the diamond business in leading countries since diamonds are valued in USD. Furthermore, the explanation of why diamonds appreciate and depreciate also includes the economic variables such as the size of the economy and the rate of employment in these specific regions.

Consumer Preferences and Trends Shaping Diamond Value

- Ethical Sourcing and Sustainability: People tend to look more at the source and sustainability factor of diamonds nowadays. Conscious customers want conflict-free diamonds and applaud the use of certifications such as the Kimberley Process because they look at what impact the diamond mining industry has on society and the environment.

- Lab-Grown Diamonds: Over the years, advancements in technology have led to the entry of these lab-grown diamonds, which have witnessed a lot of buyers opting for them. These products have the same structure as natural diamonds; however, they are compelling due to their cost-effectiveness and low environmental impact.

- Customization and Unique Cuts: More often than not, contemporary customers indulge in custom-made designs and unusual diamond cuts. This depicts the increased interest in embellishments, which are not mass-produced, thus increasing the need for creative pieces of jewelry.

Market Trends in Diamond Prices

Historical Price Fluctuations of Diamonds

In the last few decades, the price levels in the diamond market have occasionally remained static; at times, however, they have fluctuated due to numerous factors such as the economy and the market. The costs have primarily been determined by market supply and demand structure and modifications in people’s preferences and the global economy; quite a stereotypical assertion. For example, a recession means consumers would buy fewer luxuries such as diamonds, and the prices would drop. Meanwhile, during economic upturns, there is increased consumer activity, and hence this is accompanied by an upsurge in prices. Furthermore, growth in technology that aids in making synthetic diamonds and changes in people’s taste continue to affect the pricing of diamonds. With all these changes taken into account, the reliability of any model predicting the overall trends in the prices of diamonds over long ranges is quite questionable.

Current Data on Diamond Prices and Demand

Recent reports point out that the prices of natural diamonds have started falling gradually. The consumer market in the US and China has been one of the reasons behind positing a downward trend. However, synthetic diamonds are viable and cheaper alternatives being adopted quickly by the youth in the markets. The reason is that more and more individuals are willing to consider alternatives that are both affordable and green. As has been reported, some niche luxury segments continue to patronize quality cut natural diamonds; however, middle-segment products are not faring well due to the recessionary economy and fast-changing consumer behavior.

Future Predictions for the Diamond Market

Rising Adoption of Lab-Grown Diamonds

- With growth in technology lowering production costs and increasing quality standards, a rise in the market share of lab diamonds is anticipated accordingly. Young buyers, seeking sustainability and affordability, may inculcate new demand patterns in this domain.

Changing Consumer Spending Patterns

- Economic uncertainties and inflationary pressures may continue to influence consumer purchase decisions. The conversions in the mid-range and budget-conscious buyers are likely to favour alternative stones or lab-grown diamonds as more economical options.

Increasing Steadfast Preference for Ethical Sourcing

- Natural diamonds will set themselves apart with transparency and ethical sourcing practices. Companies that are focused on traceability and the actual implementation of ethical standards are likely to attract more socially conscious consumers.

E-Commerce Expansion in Jewelry Retail

- With the establishment of online retail, the sales of diamonds and other jewelry would primarily go through their online portals. The stronger trend forecasters behind this know-how are the try-on technology and digital marketing.

Regional Market Dynamics

- Emerging markets, especially Asia and Africa, are predicted to play a major role in diamond making. Nevertheless, higher disposable incomes are rising along with urbanization in these markets, increasing demand in those areas with global economic challenges.

The Role of Diamond Quality in Value Appreciation

Understanding the 4Cs: Cut, Clarity, Carat, and Color

- Cut - Refers to the quality of a diamond’s proportions or finish, as influenced by its interaction with light. Sparkles, brilliance, and fire of the diamond are determined by how well the stone is cut.

- Clarity - Is an assessment of the degree of inclusions and blemishes visible within the diamond’s body. The more inclusions, the lower the clarity from the grading scale.

- Carat - Refers to the mass of the stone rather than the dimension. There is a notion that bigger units are valued more; however, it relies on the other 4Cs.

- Color - Measures how white or less yellow a diamond is. This ranges from completely white to some faint yellowish colors. Dry crystal colors alter the price of the stone to a great extent.

How Each C Contributes to a Diamond's Appreciation Potential

- Cut - The symmetry and proportions of a diamond determine how well it can refract light. These skills will influence light refraction or bling within the diamond. A poorly proportioned diamond will look less vibrant and appealing, resulting in a lower market price – common is supply.

- Clarity – Higher clarity grades refer to those diamonds with the least amount of inclusions and blemishes and by extension, the most valuable. Hence, diamonds with a flawless or internally flawless clarity that are exceptionally rare in nature can usually enjoy more premium appreciation levels.

- Carat – This is because the size of a stone is addressed in carats, and the finer the stone, the higher the worth of the stone, particularly as these types of stones are scarce. These tendencies and appreciation over time may be present in these diamonds.

- Color - Purest and clearest diamonds never go out of style, therefore, they are considered to be of a higher rank. Those who have a better color are more appealing, especially if there are bigger diamonds, and such diamonds are worth more money because they will have a high potential for appreciation.

The Impact of Colored Diamonds on Value

The value of a colored diamond is shifted positively by the rarity and appeal of the color. Diamonds with a solid color are better than colorless diamonds, but diamonds such as pink, blue, and green are exceptionally rare, as well as very expensive. The value of such diamonds is determined by the rich color present in a more intense shade, as well as the uniformity of this coloring, as more intense colors with even coloring are preferable. In addition to this, some colors have a high estimate due to either historical reasons or the contemporary predicament of the colored diamond market. The rarity of such brilliantly colored stones and the prospects of profiting from the stones in the long run prompt investors and connoisseurs to focus smartly on these gems.

Investing in Diamonds: Practical Tips

Assessing Potential for Value Appreciation in Diamonds

When one is taking into account the prospects of a diamond appreciating in value, the following factors must be focused on:

- Quality: When it comes to preservation or appreciation of value over a period of time, the diamond with high quality and the best cut, clarity, as well as color has more chances of appreciation. This is why one should go for stones provided by GIA or a similar organization with a certificate of quality.

- Rarity: As an example, the less common diamonds that are of special colors, such as blue or pink, or shapes tend to appreciate faster than the regular ones because of the low supply.

- Market Trends: Look at the current status of diamond prices and demand, and also the history. Fluctuations in the economy, tastes of consumers, and geographic regions will also play a part in the value.

- Provenance: In some cases, diamonds, owing to their origin or history, have an added value. It is mandatory to have all relevant documentation and confirmation of origin.

If these aspects are taken into consideration properly, it will be possible to understand which diamonds have high opportunities for appreciation in value.

Choosing Reputable Sellers and Understanding Certification

In the midst of the diamond-buying frenzy, a slight sense of tranquility can be experienced. Engage with sellers who would explain in very plain language the whole process and economic model, return policies, or guarantee mechanisms. Ideally, one should confidently check the type of market these dealers operate in before any transaction takes place, either by researching feedback from prior customers or seeing if such traders have memberships in organizations such as the Gemological Institute of America (GIA) or the International Gemological Institute (IGI).

Hence, with the importance of grading for diamonds, it almost becomes equivalent to defining diamond buyers. A buyer should always seek future maintenance of the grading certificate from an institution such as GIA or IGI that they have trust in for testing individual diamonds. This diamond grading report will give the buyer all the vital information about the actual diamond, such as carat weight, real shape, and accepted if clarity and color. These things expose the buyers to risks while buying a gemstone, as diamonds appreciate value according to the degree of security and are unaffordable.

Evaluating Rarity and Uniqueness in Diamond Investments

Resourcefulness in diamond investments is directly proportional to the diamond quality and distinguishing factors. The 4Cs- carat weight, cut, clarity, and color characteristics- are the conventional parameters used in the assessment of the rarity of the diamond. Furthermore, the duration of certain colors (such as pink or blue diamonds) or their residence histology are a couple of other factors leading to more chances of its being distinct. Obtaining certified diamonds from well-recognized laboratories gives credibility to these aspects, thus investors know how much a diamond is worth, and if its value will increase over time.

Weighing the Pros and Cons of Diamond Investment

Do Diamonds Generally Appreciate in Value?

Normally do diamonds appreciate in value, in the long run, yes but this is not a rule. This appreciation depends on many variables, among which are the quality and demand within that given market. Diamonds that are of a very high grade with specific features, for example, clarity, carat, or a certain colour, tend to appreciate more. Though economic performance and dynamics of the luxury market also determine how much they can be sold for later. On the other hand, most commercially designed diamonds rarely surpass their value greatly, which makes it necessary to assess the type of diamond before thinking of investing in it.

Comparing Diamonds to Other Investment Options

Great pixels are based on the value of the liquid asset. Diamonds, therefore, are liquid, portable, appreciable, and risk-great performers.

|

Parameter |

Diamonds |

Stocks |

Real Estate |

Gold |

Art |

Luxury Goods |

|---|---|---|---|---|---|---|

|

Liquidity |

Low |

High |

Medium |

High |

Medium |

Medium |

|

Portability |

High |

Low |

Low |

High |

Medium |

High |

|

Appreciation |

Mixed |

High |

High |

Stable |

High |

Trend-based |

|

Risks |

High |

Medium |

Medium |

Low |

Medium |

High |

|

Income |

None |

Dividends |

Rent |

None |

None |

None |

|

Storage |

Easy |

N/A |

Complex |

Easy |

Complex |

Easy |

|

Market |

Niche |

Transparent |

Transparent |

Transparent |

Niche |

Trend-driven |

Final Thoughts on Building a Diamond Portfolio

Research and understanding the market are essential in forming a portfolio of diamonds. I believe that the most important thing is to focus on high-quality or rare diamonds, which have specificity in them, as they tend to depreciate less and appreciate more. Equally, it is vital to observe economic patterns and changes in customer demand to help in decision-making. It is then necessary to note that, despite the fact that diamonds are capable of being integrated into an investment plan, they do not appreciate like any other asset when included and require just as much caution in their use.

Frequently Asked Questions (FAQs)

Q: Do diamonds tend to appreciate in value over the years?

A: Yes, indeed! Over time, prices of diamonds regarded as high-quality and in the very rarest category have drastically gone up. Apart from that, there are also one or more considerations regarding demand, the general market, and diamonds themselves that affect the consideration that a given diamond will sell for over a given period.

Q: Why are pink diamonds good investment assets?

A: Pink diamonds are one of the rarest colored diamonds existing in the world; consequently, they are very high in demand, and there is nearly an assurance of appreciation over time. The less abundant these diamond colors are, the higher the valuation, and they will be a trophy for anybody wishing to procure their diamonds for appreciation.

Q: What causes the value of a diamond to vary widely?

A: The value of a diamond is often influenced by diverse elements, including the showcase patterns, the quality of the precious stone, and types like genuine blue diamonds or fancy color diamonds. Accordingly, these aspects may facilitate the understanding of the exchange options in selling a particular diamond.

Q: What makes engagement rings excellent investments?

A: Engagement rings, houses of gorgeous, splendid, and costly diamonds, the more years that go by, tend to yield a greater return on price. Diamonds have always been accepted as a classic and icon of jewelry, so their price will indefinitely hold value and appreciate. Hence, an engagement ring has not only come to be a symbol of love, but it is also viewed as some kind of business gift.

Q: What are the things to consider when you are selling diamonds?

A: It is always important to keep in mind that markets for diamonds tend to go up and down. Also, when you are selling a diamond, it is important that you analyze the particular diamond's quality and size, and according to the supply in the market, you time your selling and set your price.

Q: How do diamonds appreciate? Why is it a good idea to collect fake diamonds if they are less likely or affordable for most buyers?

A: Though alchemic diamonds tend to be cheaper and more appealing, one can not say the same thing regarding the value appreciation of alchemic diamonds. Natural diamonds, in particular, those of great worth and rarity, like Argyle diamonds or a large diamond, may be of greater preference to investors than alchemic diamonds.

Q: What should I do to evaluate a diamond?

A: It totally depends on what weight, cut, color, and clarity a diamond piece happens to be. However, the current retail prices and economic changes in the world can affect the value of your diamond, and this is why, if a diamond or diamond piece is to be evaluated, it is important for it to go through an appraisal process.

Q: How can one identify expensive diamonds?

A: Expensive diamonds are usually of excellent cut, good clarity, perfect color, and good carat weight. Pink pouch diamonds or even yellow radiant diamonds, owing to their rare occasions' presence, are more prone to appreciate in value in the future since such features among collectors and such kind of diamonds are highly valued as well as invested.

Reference Sources

- Stanford University: Are Diamonds A Good Investment-The article treats market volatility and potential long-term appreciation of diamonds.

- Columbia University: Deconstructing the Price of Diamonds- This study explores expert views on diamond appreciation, to the effect that diamonds tend to retain value or, at best, appreciate rather slowly.

- Diamond

- Diamond clarity

- Jewellery

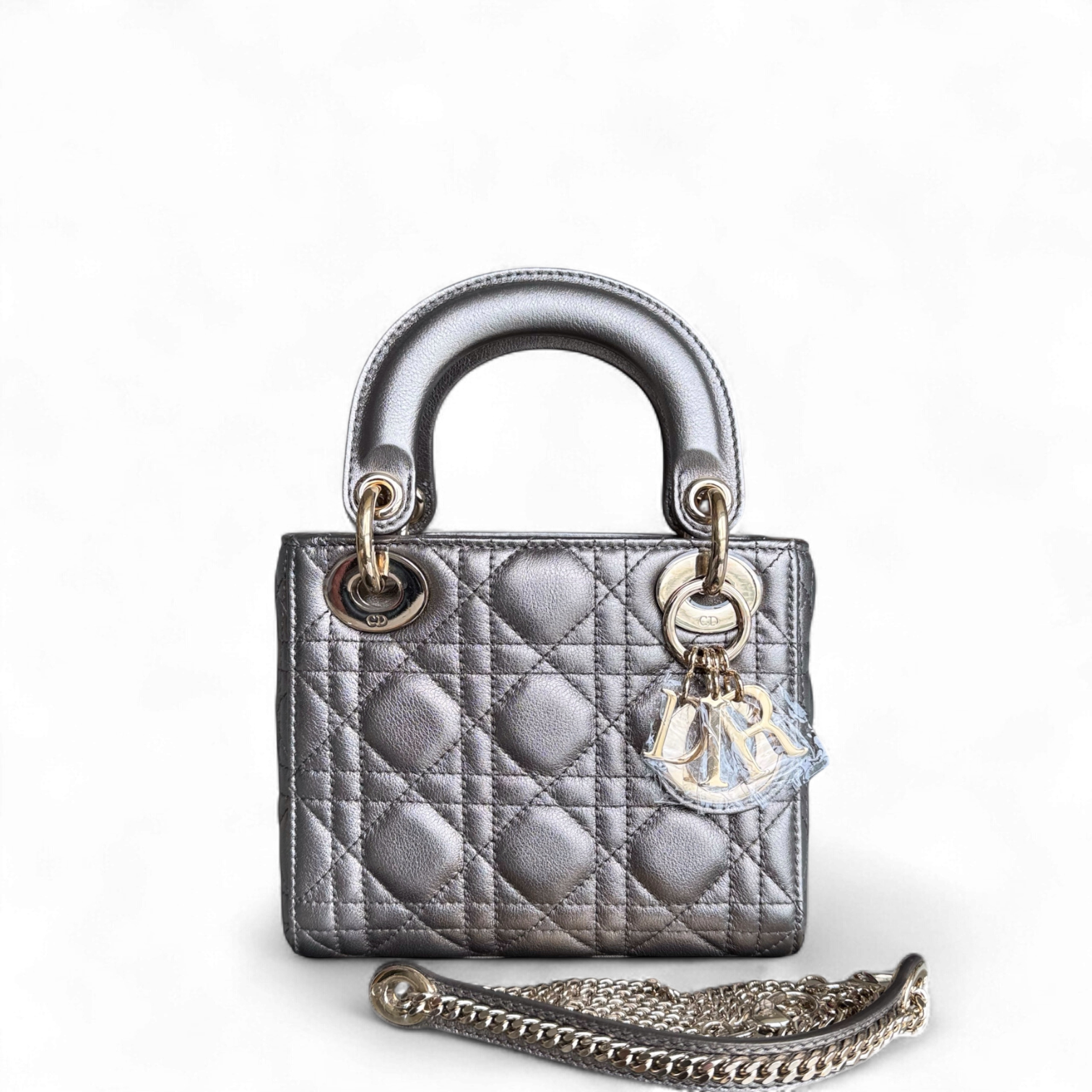

Contact Luxury Evermore should you need help with acquiring or building up your collection. There is a variety of brands with different styles, as well as sizes, and colors, for example, Hermes, Chanel, lv and Dior. If you are not lucky enough to find the bag you are looking for on our website then our concierge team will probably be able to order it for you. We provide 100% authenticity guarantee for all our bags, and any item sold on this site will be dispatched to you within one to two business days upon receipt of the payment.