Best Watch Investment: A Guide to Luxury Watch Investment Opportunities

Investing in luxury watches has evolved from a connoisseurial passion into a lucrative investment opportunity. Luxury timepieces are exquisitely crafted with timeless skill, are rare in number, and have everlasting value-they offer a unique synthesis of beauty and opportunity for profit. This guide will delve into the intricacies of watch investment, enabling you to understand why specific brand models retain or even increase in value over time. From a practiced collector to someone just dipping their toe into the pond of luxury watch investments, this article will give you essential insights about market trends and strategies to help you make the best choices. By the end, you will surely have gathered some appreciation for both art and science toward these exquisite creations.

Understanding the Market: Factors Influencing Watch Value

- Brand Reputation: Since craftsmanship and desirability are well-established, brands such as Rolex, Patek Philippe, and Audemars Piguet tend to maintain or appreciate their value.

- Scarcity and Limited Editions: Watches made in limited quantities generally command higher prices due to their exclusivity.

- Condition and Authenticity: The price of a watch depends on its physical condition, thorough authenticity, and, in some cases, its originality.

- Historical Relevance: Watches with unusual provenance or substantial historical significance are the key that attracts collectors and investors to the value of those watches.

- Market Demand and Trends: The shifting demands of consumers and global market trends significantly determine the present and future value of a watch.

Brand Prestige: The Role of Heritage and Reputation

Brand prestige is considered a crucial factor influencing the value of a watch, stemming from the history and reputation of its manufacturer. Those renowned watchmakers with a long tradition of excellence and innovation, such as Patek Philippe and Rolex, are thus always highly valued, equating them with the highest standards of quality and prestige. Consumers and collectors view these brands around the axes of luxury, fine workmanship, and exclusivity: the three angels of marketing that safeguard the brands themselves. An illustrious reputation founded on supreme craftsmanship and innovation over the decades generates trust and thus considerably enhances the desirability of a brand worldwide. The classic supply and demand scenario is all that heritage and reputation do for modern luxury watch sales.

Rarity and Limited Editions: Why Scarcity Drives Value

Scarcity substantially increases the value perception of luxury watches. The limited edition watches represent something collectors wish to treasure because they offer exclusivity that cannot be easily duplicated. Limited availability creates a sense of urgency and prestige, which increases demand. They thus use low volumes of production to increase demand while also maintaining their stature. Due to the high demand for these rare products, their desirability and value increase over time.

Condition and Provenance: Importance of Original Components

Original components are critical in establishing the condition and the provenance of a timepiece. A collector associates greater authenticity and value with timepieces that still retain their original dials, hands, movements, and cases. Non-original parts significantly diminish or destroy the historical and monetary value of the watch, as they compromise its originality and conformity to manufacturer specifications. Verifiable provenance, supported by documentary evidence such as a certificate, receipt, or service record, significantly enhances the credibility and attractiveness of the piece. Together, these stand as essential markers of authenticity and market value.

Top Brands to Consider for Investment

Rolex: Consistent Value Retention

Rolex watches have earned a solid reputation as one of the most reliable brands for retaining value and making long-term investments. Known for precision, craftsmanship, and iconic designs, Rolex watches normally appreciate, especially rare or limited-edition pieces. According to recent market trends, iconic models such as the Rolex Submariner, Daytona, and Datejust are in robust demand in secondary markets.

The Rolex brand maintains its value primarily by controlling production numbers and maintaining steady worldwide demand, placing it high on the prestigious, investment-grade watch list. For instance, sometimes, pre-owned Rolex watches sell for more than their retail price, particularly when the pieces are discontinued designs or have rare features. According to a 2023 market report, some vintage Daytonas, such as the Paul Newman, have gone for auction prices of millions. This proves that the collectors will continue to cherish classic Rolex timepieces as investment luxury watches.

Additionally, it is these materials, such as Oystersteel and 18-karat gold, that enhance the watches and contribute to their appeal. Along with the promise of superior performance and durability that models such as the GMT-Master II and Explorer are renowned for, they are considered the epitome of reliability. One could regard a Rolex investment not only as a badge of honor to wear but also as a fairly steady financial performance, therefore, a good return on investment in the luxury-asset space.

Patek Philippe: High Returns on Iconic Models

Patek Philippe is the pledge of timeless elegance and superlative craftsmanship, and thus it is one of the most sought-after brands in the luxury watch category. Classic models like the Nautilus and Aquanaut continue seeing sideways appreciation beyond standard measures. With maturity, auction deals serving the superlative measure have come down to the high secondary market, forcing another round of appreciation much beyond retail prices. The recent surge in demand is primarily due to limited production, the intricacies of design, and the brand's reputation.

More than just market desirability, Patek Philippe's intention to innovate and maintain exclusivity contributes to its interest. The Grand Complication watches, with their numerous complications, present engineering feats that include perpetual calendars, split-seconds chronographs, and minute repeaters, making them highly sought after by collectors and investors. According to respected market research reports, the value of Patek Philippe watches has consistently remained strong in auction and private sale settings, demonstrating their viability as tangible assets. Thus, investing in these timepieces takes one down a path that combines culture and prestige, and also illustrates the solid income-generating capability of luxury goods within diversified portfolios.

Audemars Piguet: The Enduring Appeal of the Royal Oak

Introduced in 1972, the Audemars Piguet Royal Oak significantly bolstered the popularity of luxury watchmaking through its unusual design and its innovative use of stainless steel in making a high-end timepiece. Conceived by the renowned watchmaker Gérald Genta, the octagonal bezel with exposed screws and the integrated bracelet soon became a defining characteristic of the collection. On the cutting edge aesthetically, the Royal Oak elegantly blended sportiness into the equation, essentially carving out a new clientele for luxury sports watches.

The continually rising demand for Royal Oak watches can be gauged by their successful price performance and scarcity on the market—specific Royal Oak watch models, such as the Royal Oak Jumbo Extra-Thin Ref. 15202ST, according to reports, has been able to demand huge premiums in the secondary market, with the price often going far above its retail price. This phenomenon represents not just a long-standing demand, but also being among the favorite watches of collectors and an emblem of exclusive status.

In furthering the innovations of the Royal Oak, Audemars Piguet introduced advanced materials, such as ceramic and titanium, as well as ultracomplex movements, including perpetual calendars and skeletonized calibers. These advances represent technical expertise while also preserving the timeless spirit of the original design. Arguably, therefore, the Royal Oak earned its legendary status as a luxury sports watch and continues to be the benchmark in both inspiration and technical sophistication.

Spotlight on Iconic Models: Must-Have Timepieces

Rolex Submariner: A Symbol of Dive Watch Excellence

The Rolex Submariner has been characterized as the epitome of durability, functionality, and design. In 1953, the watch was introduced, recognized as the first wristwatch resistant to water 100 meters (330 feet), thereby advertising itself as a professional diver's watch. Today, the water resistance was increased to 300 meters (1,000 feet), positioning the watch between a diving sports luxury and an accessory.

Ensuring accuracy and dependability are Rolex's in-house movements: the caliber 3235 for date versions and the caliber 3130 for no-date versions. These self-winding mechanical movements feature a Chronergy escapement, which enhances their efficiency and power reserve, now extending to approximately 70 hours.

Built of either Rolex's exclusive Oystersteel or great 18-karat gold, the Submariner case stands firm against high underwater pressures. It features a unidirectional bezel with Cerachrom ceramic inserts, which help divers track immersion time and provide the surface with extreme resistance against scratches that accumulate over years of use.

The Submariner goes beyond iconic design with its high-visibility Chromalight display, which remains legible even in the subdued lighting environment of ocean depths. Famed for its ruggedness and precision, the Submariner pairs well with a wide range of outfits and quickly gained popularity among divers, collectors, and watch enthusiasts alike.

Patek Philippe Nautilus: The Ultimate Luxury Steel Sports Watch

The Patek Philippe Nautilus is a design and manufacturing marvel, embodying in every way the perfect balance of elegance and utility. In 1976, Nautilus, designed by legendary Gérald Genta, practically invented the luxury sports watch category with its innovative porthole case design and horizontally grooved dial. The watch was engineered from specially corrosion-resistant stainless steel, with the intention of being both durable and slightly elegant on the wrist, able to transition with ease from casual wear to a dinner party setting.

The iconic reference 5711/1A is arguably the most recognizable watch within the line. It features a 40mm case, housing a self-winding Caliber 26-330 SC movement with a power reserve of over 45 hours, and incorporates a date window at 3 o'clock. In addition to the date function, the hands are filled with luminescent material (Superluminova), making them easy to read even in the dimmest of conditions. The watch is waterproof to 120 meters (394 feet), allowing one to engage in various water-based activities without worrying about the mechanical integrity of the Nautilus.

The Nautilus lineup has expanded, offering models in rose gold, white gold, and platinum, as well as those featuring complications such as chronographs, moon phases, and annual calendars. Its limited editions and unparalleled expertise in watchmaking keep the demand alive in the eyes of collectors and connoisseurs. By combining cutting-edge technology with timeless elegance, the Patek Philippe Nautilus aspires to leave its mark as a household name in the world of horology and prestige.

Omega Speedmaster: Historical Significance and Resale Value

The historical significance of the Omega Speedmaster, affectionately known as the "Moonwatch," is unparalleled in the world of horology. First launched in 1957 for motorsport enthusiasts, it grew into a legendary luxury timepiece when NASA chose it for the Apollo moon missions. The Speedmaster gained fame as the first watch to be worn on the lunar surface during the Apollo 11 mission in 1969, making it a part of history alongside space exploration. This association has, therefore, propelled the Speedmaster into an icon, celebrated for precision in timekeeping, durability, and establishing one of man's finest achievements.

From a resale perspective, the Omega Speedmaster continues to command hefty prices due to collectors' demands, solid craftsmanship, and limited editions that pay tribute to its heritage. Auction data confirm that rare vintage models, such as the CK2915 or pre-moon references, often fetch extraordinary amounts of money, with six-figure sums depending on the condition and provenance. The recent limited editions, celebrating NASA collaborations or historic anniversaries, have also garnered very strong prices in secondary markets.

Adding to its appeal is that the Speedmasters' design has remained essentially unchanged over the past few decades, having undergone only subtle changes in materials and movements. Newer versions featuring Co-Axial Master Chronometer movements demonstrate precision and enhanced resistance to magnetic fields, further underscoring the essence of a highly celebrated timepiece. The desirability of this watch ensured that the Omega Speedmaster remains not only a collector's item but also an investment opportunity for anyone seeking an iconic timepiece with lasting appeal.

Investment Tips: How to Choose Wisely and Maximize Returns

Research and Market Knowledge: Understanding Trends

To make investment decisions, one must analyze the prevailing market environment and unfolding trends. For instance, knowing the increase in demand for companies committed to environmentally sustainable causes could guide one to invest in a green energy company or an ESG-compliant fund. Monitoring sector-specific growth projections also isolates industries with immense potential, such as technology, healthcare, or luxury sports.

Recent data indicate that the growth of the renewable energy sector is expected, further stressed by global initiatives to reduce carbon emissions and consumer demand for clean energy solutions. Likewise, technology upgrades in fields such as artificial intelligence, cloud computing, and cybersecurity further offer luxuries with good investment returns. Being aware of these patterns and predicting changes in consumer and industry priorities will give one a strategic advantage in acquiring good assets while avoiding the downside risks.

Authenticity Assurance: Avoiding Counterfeits

Authenticity is ensured while avoiding the counterfeits. Purchase from verified and reputable sellers to help ensure this. Check certifications, official warranties, and any other written documentation provided either by the manufacturer or authorized dealers. A close-up comparison of labeling and packaging will sometimes reveal inconsistencies. Many counterfeit items exhibit poor printing quality, misspellings, or logos that are misaligned in some way. If possible, ask the brand for confirmation regarding the serial numbers or other unique mark numbers. For very valuable or high-risk products, use qualified third-party authentication services. Protecting oneself against counterfeits is a matter of staying cautious and informed.

Timing the Market: When to Buy and Sell

Effective market timing requires strategic analysis, economic insight, and a broad understanding of market trends. Determining the best time to buy involves identifying periods when the market is undervalued or when prices have dropped due to recent economic downturns, thereby allowing for the acquisition of assets at a discounted rate. These primarily involve examining P/E ratios, earnings reports, or sector-specific performance indicators.

In contrast, selling is often observed during times of apparent overvaluation, upon reaching profit targets, or under the shadow of economic conditions pointing toward a downturn. From a historical perspective, periods of exuberance in the markets, characterized by overvaluation or excessive price rallies, have presented an opportunity for some investors to exit certain positions. Investors should also consider macroeconomic indicators that influence changes in interest rates, inflation rates, and geopolitical events, as these factors will invariably steer market momentum.

Utilize technological tools for enhanced decisions: predictive analytics, stock screeners, or algorithmic models. The most well-timed decisions can go awry due to volatility; hence, diversification becomes essential. Decisions are made based on quantitative analysis and qualitative perceptions, resulting in a balanced and professional approach to investment.

Potential Future Trends in Watch Investments

Rise of Independent Watchmakers: Growing Interest

Independent watchmakers have become increasingly in demand among collectors and investors due to a growing appreciation for craftsmanship, exclusivity, and innovation. These are very small producers, typically managed by visionary artisans, who bring creativity and design from an individual perspective that is far removed from mass-manufactured luxury watches. Industry reports suggest that the independent watchmakers market has experienced consistent growth, supported by a growing group of fans who appreciate bespoke designs and complex complications.

Brands such as F.P. Journe, H. Moser & Cie, and MB&F have defined the forefront of horology with inventive design features and modern mechanical improvements. For instance, the F.P. Journe Chronomètre à Résonance is considered a technological marvel due to its unique dual-resonance system. Analysts have also formed the opinion that reductions in production runs, as well as the scarcity of these highly precise timepieces, enhance the long-term investment prospects. On the other hand, younger collectors tend to be drawn to these brands as they find them more relatable and distinctive compared to mainstream traditional language.

This shift in demand tells the tale of an ever-evolving watch market in investment, wherein customers crave unique stories and the genius of artisans rather than the volume-driven prestige of luxury watches. The experts would advise keeping a watchful eye on newly blossoming independent brands while weighing the historical importance and technical excellence of their work, as these are elements that weigh heavily in determining their future value.

Shift Toward Precious Metals: Demand for Luxury Materials

The demand for precious metals, such as gold, platinum, and palladium, in luxury goods, especially watches, is increasing, being linked to their inherent nature and timelessness. Market research indicates that there is a growing trend of preference for watches featuring solid gold cases and platinum bezels, driven by both aesthetic appeal and investment value. It is also strengthening with a better appreciation of the higher craftsmanship required in working these metals.

Gold remains the most sought-after material, regarded as a symbol of the fusion of elegance with lasting durability. In recent years, it has been reported that gold watches hold their value more consistently than stainless steel variants, thus presenting themselves as an attractive offering for collectors and investors alike. Against this backdrop, platinum is now steadily gaining favor for small editions, in turn appealing to the high-net-worth crowd. Palladium, yet another precious metal, enters modern watchmaking with its hypoallergenic and anti-corrosive properties as key selling points.

Additionally, the ethical procurement of these metals is becoming increasingly important to luxury consumers. Brands that continue to market their product along the lines of ethical mining practices and fair trade certifications are undoubtedly gaining ground among the green-conscious buyers. This also means that the demand for precious metals does not revolve solely around aesthetics or investment value but also around a shift in consumer association toward sustainability and transparency.

Younger Buyers Driving Demand: The Impact of Generational Shifts

Generations younger than Millennials and Gen Z are driving significant opportunities and changes in market trends through their purchasing decisions. Roughly 70% of Gen Z shoppers are said to prefer buying from a brand that focuses on sustainability, while nearly 60% of Millennials are creating a similar force of demand by actively prioritizing ethical considerations in their purchases. Reflecting this generational shift, luxury brands have been adapting their strategies, placing an emphasis on transparency in the sourcing of goods, sustainable production methodologies, and reducing environmental impact.

Lastly, the purchasing power of these demographics is already expanding rapidly, with Gen Z estimated to have a global income exceeding $33 trillion by 2030, accounting for more than 25% of the world's income. Specific influences by them constitute the genesis of new practices, such as blockchain technology to confirm supply chain authenticity and carbon offset programs that directly relate to products. These shifts, combined with a powerful digital presence and a preference for brands that live up to their claims, are driving a comprehensive change in the detailed strategies companies must undertake to stay competitive in a rapidly evolving market.

Frequently Asked Questions (FAQs)

Q: What makes a luxury watch a good investment?

A: A luxury watch is a good investment because it has the potential to appreciate over time, particularly in the case of Rolex and Patek Philippe watches. These watches are often handsome investments that can retain their value or even appreciate over time.

Q: Which brands are considered the best investment watches?

A: Some of the best investment watches include top luxury watch brands like Rolex, Patek Philippe, and Audemars Piguet. The quality and craftsmanship these brands represent, together with their limited production runs, have always equated to strong market value and investment potential.

Q: How do vintage watches fare as an investment compared to modern watches?

A: Vintage watches are very likely to appreciate, especially the rare ones of esteemed brands. The modern watch, while considered an investment in its own right, is not as strong in the collector's market as the vintage watch, which makes it a good option for sustained value retention.

Q: How good is the investment potential in the Rolex Daytona?

A: The Rolex Daytona has always been agile regarding its investment potential because of its design and rarity. Most watch aficionados regard it as one of the prime watches to invest in for appreciation.

Q: How can I find the top watches to invest in?

A: To find the best watches to invest in, consider the attributes of brand reputation, market demand, historical value retention, and condition. Your research on current luxury watch market trends will also guide you toward timepieces with a strong investment potential.

Q: What are the risks in luxury watch investments?

A: Like any investment, there are risks when buying luxury watches; for example, market changes and changes of heart on the buyer's part. It is advisable to conduct thorough research and, if necessary, seek guidance from an expert in the luxury watch industry to mitigate these risks when purchasing watches.

Q: Do pre-owned luxury watches make a good investment?

A: Yes, pre-owned luxury watches can be very good investment options. Most security watches give lower prices than brand-new ones while maintaining their great value and investment potential. Also, some pre-owned watches may increase in value more than new ones.

Q: What needs to be considered before deciding to invest in a watch?

A: Brand, condition, market trends, and potential for long-term value increase are factors that one has to consider before investing in a watch. Being aware of where your money is and what your goals are for this investment can give you the edge in making knowledge-driven decisions.

Q: How do luxury watches manage to maintain their value over time?

A: Luxury watches retain their value through a combination of factors in marketing, limited production, and demand. Watches from prominent brands, such as Rolex or Patek Philippe, tend to command high demand due to their resale value and appeal to investment buyers.

Q: How to best invest in luxury watches?

A: One of the best investment strategies for a portfolio of luxury watches is diversification. One should increasingly focus on brands that have a positive history of appreciation and stay informed about market developments. Engaging with watch aficionados in various forums may also give invaluable insight regarding items that might be good investments.

Reference Sources

1. Investment Performance and Strategies

- Paper: "Best Buys and Own Brands: Investment Platforms' Recommendations of

- Mutual Funds" (Cookson et al., 2019)

- Date of Publication: 2019

- Key Findings:

- Examined how investment platforms recommend mutual funds

- Found platforms oftentimes promote their own-brand funds

- Investors are prone to disbelieving recommendations of their own-brand funds

- The transparency of recommendations can be affected by regulatory changes

2. Stanford University - Investment Watches

- Investment Watches

- This source discusses top brands such as Patek Philippe, Rolex, and Audemars Piguet for their quality and investment opportunities.

3. Watch

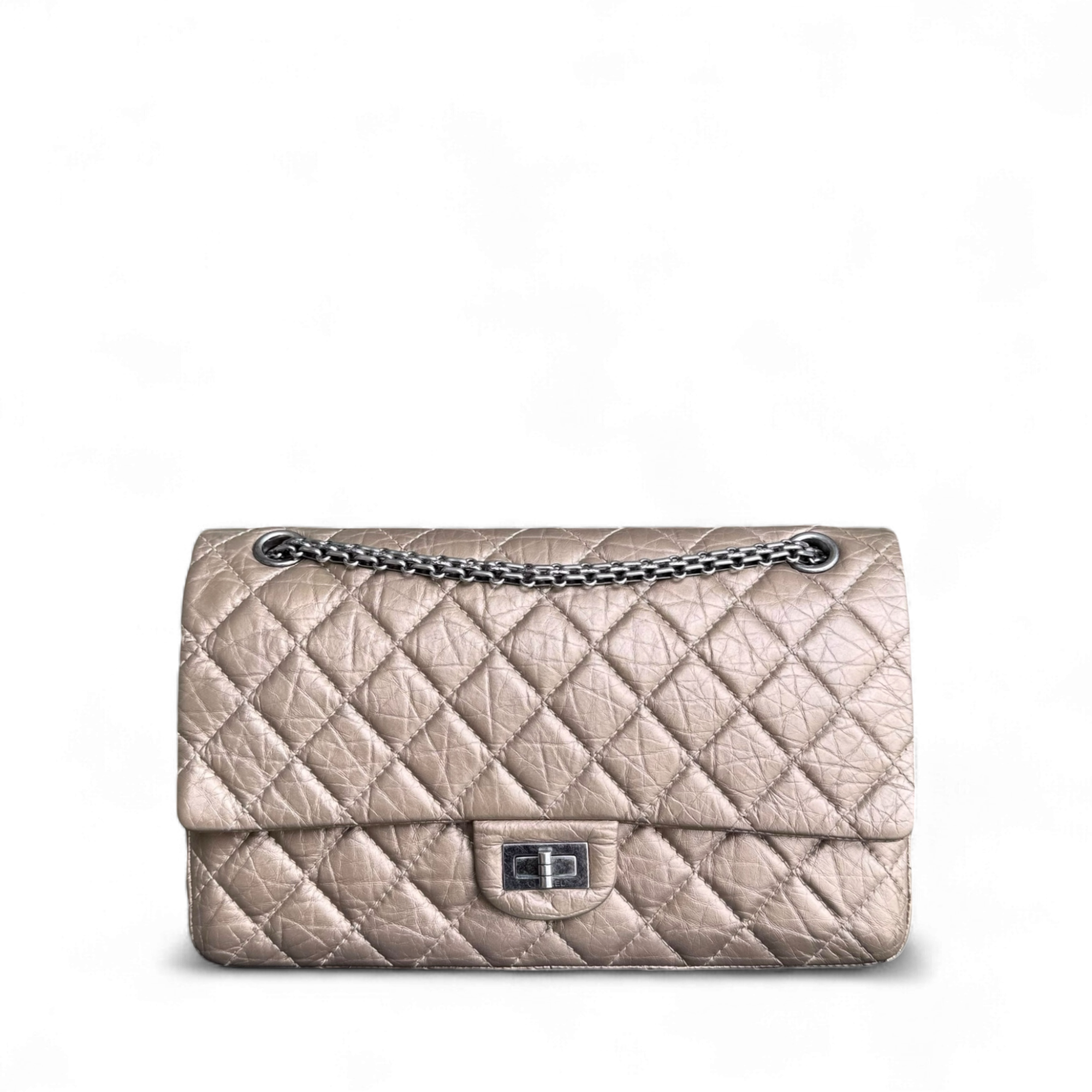

Contact Luxury Evermore should you need help with acquiring or building up your collection. There is a variety of brands with different styles, as well as sizes, and colors, for example, Hermes, Chanel, lv and Dior. If you are not lucky enough to find the bag you are looking for on our website then our concierge team will probably be able to order it for you. We provide 100% authenticity guarantee for all our bags, and any item sold on this site will be dispatched to you within one to two business days upon receipt of the payment.