Why Are Diamonds So Expensive? Unveiling the Mystery Behind Diamond Prices

Throughout human existence, diamonds have mesmerized societies and have been regarded as a symbol of beauty and lasting value due to being rare. But the question still remains: what makes diamonds so expensive? Is it their rarity, or does it also stem from other areas? In this article, I will outline the many aspects of gemstone pricing, like economic standing and geology, and their implications on society's constantly evolving and intricate view of a diamond's value. By the end, readers will understand why mesmeric diamonds have a bewildering value attached to them while unearthing their hidden realities.

What Makes Diamonds So Expensive?

The economic value and price of diamonds are attributed to many factors, such as their extreme scarcity, the complicated extraction process, and market forces. As with all other natural diamonds, they are exceedingly hard to come across since their formation occurs naturally over billions of years deep within the Earth’s mantle under very high pressures and temperatures. Extracting them from the earth requires specialized skills and extreme care, which makes the entire process very costly, inflating the price of the gemstones even more. A diamond’s price also increases due to the steadfast regulation of supply by the diamond industry and effective promotional campaigns portraying diamonds as symbols of love and status. These stones are widely considered the most exquisite and valuable gemstones worldwide due to the combination of the aforementioned factors, both geological and cultural.

The Role of Diamond Rarity

The formation processes, availability, and quality of diamonds constitute their rarity. Natural diamonds are cultivated through extreme heating and pressurization over billions of years at the Earth's mantle, making them geo-scarce. In addition, the stringent quality standards of gemstone diamonds augment their rarity further, as only a small proportion of mined diamonds are endowed with such standards. The durability of diamonds, coupled with their inextinguishable brilliance, is the reason for their value and desirability.

Understanding Diamond Clarity and Quality

Diamond clarity determines the degree to which a gem contains any internal inclusions or external blemishes. Using magnification, imperfections in clarity grading are observed and evaluated by type, size, location, and visibility. GIA, or the Gemological Institute of America, employs a clarity grading scale, ranging from Flawless (FL) to Included (I1, I2, I3). Diamonds containing inclusions or blemishes to the extent that they are visible are graded Included, while those with no visible inclusions or blemishes are flawless. This type of diamond is very rare and highly sought after. Highly sought after and extremely valuable, diamonds graded Flawless are the worst types of diamonds to invest in since they contain no visible blemishes or inclusions.

For modern studies, less than one percent of diamonds achieve the Internally Flawless or Flawless grades and are therefore sought after. Compared to diamonds, grades with Very Slightly Included and Slightly Included tend to be the preferred option thanks to their low price. These diamonds maintain their brilliance while containing microscopic inclusions. Imaging technologies have advanced, so jewelers, along with buyers, can accurately measure the inclusions, and evaluation becomes simpler.

Also, placement and type of inclusions carry value, as highlighted by the industry data. For example, pinpoint inclusions situated below the diamond's table are likely to impact its brilliance, whereas those situated on the edges are usually ignored. This detailed information is essential in establishing a diamond's quality and its price in the market.

The Impact of Diamond Cut on Price

The value of a diamond is highly contingent on its cut, primarily because it affects the gemstone's brilliance and overall value. Diamonds that are appropriately cut are able to reflect light, which increases their shimmer and appeal, making them more valuable in turn. On the other hand, diamonds with poor cuts tend to be unattractive and lackluster, dissociating them from the market price. The cut of a diamond is one of the 4 Cs of diamond evaluation (Cut, Carat, Color, Clarity). However, it is usually rated as the most important because of the elegance a well-shaped diamond has owing to the light interaction.

How Do Diamond Mines Influence Pricing?

Exploring Diamond Production and Supply

Diamond production is one of the factors defining the supply side of the market, and naturally, prices are dependent on the trends. The primary sources of diamonds in the world are large-scale mining industries in Russia, Botswana, Canada, and Australia. As of the latest reports, Russia seems to be emerging as a key player in the market as it garners 30% of the diamond production in the world. Botswana is also a famous producer of diamonds because of the quality of its gems, and it supports global supply with its miffing-enhanced economy.

On a yearly basis, the diamond industry mines around 120 to 130 million carats, but this number is relative to the state of the market, investment in mining excavation, or global politics. In the case of global conflict or during pandemics, supply chain resources can run dry, which impacts rough diamonds stock and rate.

The rise in technology has transformed the diamond industry. Now, synthetic diamonds are also part of the supply along with natural ignition diamonds, therefore controlling prices. Laboratory altered diamonds are produced 20% to 40% cheaper than natural diamonds which shifts the curve of the market.

Comprehending the levels of production and trends of supply is crucial for estimating pricing and evaluating market opportunities, as the equilibrium of supply and demand continues to be the pivotal factor in determining the pricing of diamonds.

The Economics of Diamond Mines

The economics of diamond mining is impacted by various key factors, such as cost of extraction, resource availability, and global demand. The cost of exploration and setting up a mining site, which includes infrastructure, equipment, and skilled personnel, is considerable. Furthermore, the availability of diamond deposits and the market's willingness to pay are critical factors. Additionally, mined diamond value changes with market demand due to consumer spending, economic situation, and competing options like lab-grown diamonds for lower prices. Sustainability and ethical sourcing practices have become critical economic considerations as consumers and stakeholders focus more on these factors to shape value-based decisions in the industry.

How Mining Diamonds Adds to the Cost

The diamond mining process is multifaceted and strenuous, with diamonds being of chief importance, which increases their overall cost. One of the primary drivers of the total cost is the infrastructure expenditure related to construction and the extensive groundwork accompanying diamond deposits. According to sector analysis, some of the world’s largest diamond mines may have initial capital outlays in equipment, personnel, and operational facilities that exceed several hundred million dollars. Additionally, the amount of energy utilized in mining operations is significant. In the case of open-pit mining, underground mining, and other methods, production machines and sophisticated technologies are heavily used, which escalates operational costs.

Another equally important and challenging component of the cost structure is the labor expenditure. Extensive diamond mining entails skilled diamond and surface laborers who are experts in their field, along with adequate subsector specialists who expect slaves commensurate to the level of difficulty involved in the work and the risks that must be undertaken. It is also necessary to consider the costs associated with the actual performance of international escape and modern environmental and safety requirements essential for mining companies to adjust to in order to meet policy standards, take steps towards reducing their environmental impact, and comply with Ukrainian laws.

The processes of transportation and sorting add operational costs as rough diamonds are meticulously prepared and transported to cutting and polishing centers around the globe. Research shows only about 20% of mined diamonds are gem-quality, implying that most of the cost and effort is spent on evaluating stones which potentially have little market value. Contemplatively, these insights reveal why the current method of extracting diamonds poses extreme financial challenges, further impacting the retail cost of the product.

What Is the Role of De Beers in the Diamond Market?

De Beers’ Marketing Campaign Success

Through marketing, De Beers was able to completely reshape the diamond industry by linking diamonds to love, devotion, and even luxury. Their well-known slogan, ‘A Diamond is Forever,’ is regarded as one of the most successful marketing advertising campaigns in the history of America in the 20th century after being launched in 1947 and further fueled demand for the consumer market. Diamonds sustained brand enabling partnership with jewelers by emphasizing emotional value in advertising, commanding the market for engagement rings, simply depicting diamonds in cultural contexts, and aiding campaigns in Hollywood marketing.” With De Beers' strategic campaigns and collaborations with Hollywood and Courteeners in the global market for his success arrows, he built nostalgia around being court shipped and reinforced cultural values surrounding the aspect of love and social status that accompanies owning a diamond.

Monopoly and Its Impact on Diamond Prices

The monopoly exercised on diamonds by De Beers as a single seller had a profound impact on pricing worldwide. Their monopoly on supply, retailing, and even operating at market-level supply chains, including mining and filtration processes, enabled the enterprise to influence both supply and demand-driven pricing factors. This monopoly triad allowed De Beers to maintain diamond prices at a more optimal rate than demand-based valuation. What follows next is a succinct account of how De Beers monopolized the diamond market price.

Market Manipulation

- Diamonds as resources within the economy do not fossil away unlike other luxurious metals. Hence, De Beers’ monopoly commenced by controlling the reserve. Each diamond granted gave De Beers the purchase opportunity, and so the prices would eventually climb once De Beers would permit market access.

Central Selling Organization (CSO)

- The diamonds could purportedly now be sold by De Beers. Purchase contracts made with various parties changed diamante trade within nation into monopolized diamond trading within the nation. The entire cartel bloc became buyers enabling CSO to buy as many diamonds from De Beers forcing them plus to monopolize an entire region.

Purchasing Orders For Diamonds Buying and Selling

- Demand allows sellers to foster far sent demand which instigated Leverage the perception of Artificial scarcity and artificially construct c scarcity Did monopolists decrease free market dynamics but this instead caused supply.

- Fostered demand: De Beers needed to help promote diamonds and make sellers far fetch.

Market Influence

- De Beers successfully achieved dominance in the diamond industry by forming strategic agreements with other countries and producers; for example, the partnerships with Botswana helped the country gain economically while the company was able to control the supply.

Pricing Trends

- Analysts reported over 20 years of uninterrupted price increases on diamonds during the mid-century period, which was also fueled by the monopoly’s internal enforcement mechanisms. Research suggests that many diamond prices were at least 30-40% higher than what would be available in a competitive setting.

This form of exploitation not only helps sustain the remaining architectural framework of price controls implemented by the monopoly, but assists in entrenching the disproportionate economic and cultural value assigned to diamonds which has come under increasing competition in the last few decades.

Are Lab-Grown Diamonds Affecting the Diamond Industry?

What Are Lab-Grown Diamonds?

Advanced technological processes are employed to create diamonds in laboratory settings, leading to the formation of lab-grown diamonds. Their properties are identical to those of natural diamonds that develop deep within the Earth, and they undergo High Pressure-High Temperature (HPHT) or Chemical Vapor Deposition (CVD). The use of lab-grown diamonds is steadily increasing because they are ethically sourced and environmentally sustainable featured, is additionally more economiocal in comparison with traditional mined diamonds.

Comparing Lab-Grown vs. Natural Diamonds

The following is a comparison between lab-grown and natural diamonds based on multiple factors of interest:

Composition and Properties

- Lab-Grown Diamonds: Physically and chemically, they are identical to natural diamonds, being made from crystallized carbon, which achieves a hardness of 10 on the Mohs scale, as well as light dispersion.

- Natural Diamonds: In comparison to lab-grown diamonds, these also consist of crystallized carbon but are formed under immense amounts of heat and pressure beneath the earth over billions of years. The difference is that they cannot be discerned with the naked eye.

Formation Process

- Lab-Grown Diamonds: Using advanced technology such as High Pressure-High Temperature (HPHT) or Chemical Vapor Deposition (CVD), these are created in laboratories. It takes a few weeks to produce the diamond.

- Natural Diamonds: They take an immense amount of time to ‘grow’ reproducibly, but the uniform nature of the earth's mantle enables the existence of multiple diamonds within and brings them to the surface through volcanic activity.

Cost

- Lab-Grown Diamonds: Roughly 20 - 40 percent cheaper than natural diamonds due to their controlled production processes.

- Natural Diamonds: Need an extravagant amount of money for the extended-extraction processes, limited gold supply, the exorbitant cost of mining and distribution, and thus more expensive.

Ethical Factors

- Lab Grown Diamonds: Considered an ethical option due to their production being conflict-free, as they do away with the possibility of human rights violations related to diamond mining in certain areas.

- Natural Diamonds: Though there are responsible sourcing and certifying programs such as the Kimberley Process, there continue to be issues about unsanctioned practices of mining.

Raising Issues

- Lab Grown Diamonds: As there is no mining associated with them, they have a smaller environmentally-friendly footprint compared to natural diamonds. On the other hand, the use of electricity from non-renewable sources is a matter of concern.

- Natural Diamonds: The extraction of natural diamonds tends to have a larger negative impact on the environment in terms of habitat destruction, deforestation, and carbon footprint.

Scarcity and Value Preservation

- Lab Grown Diamonds: Usually have lower resale value due to the absence of scarcity unlike natural diamonds which are also mined.

- Natural Diamonds: Treasured by collectors and investors for their uniqueness and limited availability which increases their desirability and perceived value over time.

People focus on Eco-Friendly alternatives

- Lab Grown Diamonds: Soaring in demand among those who wish to save the environment as well as those on a budget. According to Bain and Company reports, lab-grown diamonds now make up for 6-7% of the global diamond market.

- Natural Diamonds: Remain the most marketed and sold diamond types, however, they are struggling in capturing the attention of younger consumers who consider sustainability and ethics as important factors.

Applications

- Lab-Grown Diamonds: These are overwhelmingly used for industrial purposes like cutting and grinding tools because of their lower cost. They are also used in jewelry, particularly as an eco-friendly option.

- Natural Diamonds: Best appreciated for luxury jewelry and as a symbol of wealth. They have also significant emotional value due to their use in cultural and traditional practices.

The decision on whether to choose lab-grown or natural diamonds is a matter of personal preference regarding ethical spending, financial limits, and the balance between contemporary eco-friendliness and natural elements. Both options offer distinctive advantages that appeal to a broad range of consumers.

How Lab-Grown Impacts Diamond Prices

The emergence of lab-grown diamonds has made acquiring diamonds easier and more affordable compared to natural diamonds, as lab-grown diamonds are significantly less expensive. The reason for this is that lab-grown diamonds do not need to be mined from the earth, as they are created within strictly monitored environments. These production facilities have lower operating expenses relative to mines due to the absence of geographically limited resources like places from which to extract materials. The price at which lab-grown diamonds are sold is around 20 to 40% lower than that of natural diamonds since their cost of production is much less. Furthermore, the market is flooded with lab-grown diamonds, which drives down the prices of natural diamonds. This is a win-win situation, as the consumers get easy access to high-quality diamond products at lower prices, and the producers still make a profit.

Why Do People Buy Diamonds Despite High Prices?

The Symbolism of Diamond Jewelry in Culture

From the earliest of times, jewelry has been used not only to adorn one’s body but also marked important occasions and milestones in one’s life and diamond jewelry marks the most cherished of all the milestones. In U. S. A alone over 80% of engaged couples select diamond rings which is a testimony to the deep rooted culture associated with these gems and their value as cherished tokens signifying everlasting love.

Since ages diamonds have epitomized power and status, Royals and Aristocrats have long embellished themselves with these priceless gemstones as a sign of wealth and influence. In 2023 the global market of diamond jewelry was over 82 billion dollars which clearly shows the widespread appeal for it. Prized for their stunning beauty, diamonds are also sometimes handed down through generations oozing with sentimental value.

Different cultures have different perceptions associated with diamonds. For example, in some Asian countries, diamonds are increasingly being seen as a symbol of success, especially by the younger population. This surge in demand has helped further establish diamonds as a recognized symbol of luxury and has enabled them to be appreciated around the world. The beauty of diamonds, combined with their cultural significance, grants them a unique spot for people around the world.

The Allure of the Diamond Engagement Ring

Traditionally, the diamond engagement ring is regarded as a token of love and commitment owing to its capability of signifying the never-ending link between two people. This custom originated in the 15th century when Archduke Maximilian of Austria gave his betrothed, Mary of Burgundy, a diamond ring. Today, it continues to be popular because of its beauty, strength, and association with love. Currently, most people prefer round-cut diamonds because of their outstanding shine, but other shapes, like princess and oval cuts, are also very popular. Alongside the incredible brilliance of the stone, its cultural meaning gives it unmatched value, which makes it a sign of partnership.

Perceived Value of Diamonds

The value of diamonds is adjudged through the lens of their quality, rarity, and cultural importance. Considerations such as the “Four Cs”—cut, color, clarity, and carat weight—are essential in establishing a diamond’s worth. The diamond’s value, both monetarily and symbolically, has been etched in advertisements depicting it as a staple in special events like engagements with an almost religious devotion to their marketing. This, in combination with their increasing scarcity in the world, makes them viewed as more precious. Furthermore, their lasting nature makes them a reliable form of investment, while their association with love, opulence, and power deepens their allure.

Frequently Asked Questions (FAQs)

Q: What factors make diamonds so expensive?

A: The sheer value of diamonds increases because they require extensive mining and processing, along with marketing which retains their status as symbols of luxury. The diamond industry's marketing tactics also help to further drive their controlled supply in the market. This, combined with a diamond's carat weight, cut, and color, attributes to the diamond's high prices.

Q: What is the process of diamond formation?

A: This process begins kilometers deep inside the Earth's crust, where high levels of heat and extreme pressure endure over a multi-billion year timespan. Diamonds are transported to the surface during volcanic activity. This lengthy and unique process further contributes to the diamond's value.

Q: What makes some diamonds more expensive than others?

A: Diamonds that are more expensive have higher quality in the "Four Cs" model: Cut, Clarity, Color, and Carat weight. Following that model, pink or blue diamonds are also among the top-tier categories of precious gems.

Q: Are all diamonds equally expensive?

A: No, not all diamonds are equally expensive. The price range for diamonds is vast. Factors such as size, quality, and rarity significantly impact the cost. For example, a diamond with small dimensions and low-grade clarity may be inexpensive; however, a large stone with high luster and rare hues would likely be regarded as one of the world's most expensive gems.

Q: In what ways does history contribute to the high cost of diamonds?

A: Indulging in Romanticism, the history of diamonds has included the use of bearing them as emblems of power and wealth, giving them some value. Marketing campaigns, including De Beers' slogan 'A Diamond is Forever,' have marketed diamonds as love and luxury symbols. Cultured importance has likewise ensured that diamonds maintain their high demand and, subsequently, high prices.

Q: What is the systematic procedure for buying a diamond, and in what manner does it influence the price?

A: When buying a diamond, most people overlook the fact that they are often only paying for the stone and not only the stone. The supply chain begins at the diamond mine, and it includes cutting polishing, and even certification. At every individual step, additional costs are incurred, which cumulatively amplify the cost of the stone. Furthermore, retail markups, which are generally exorbitant, also include the price one pays. Knowing the procedure helps make smarter decisions when buying diamonds.

Q: Are there alternatives to expensive earth-mined diamonds?

A: Yes, there are alternatives to expensive diamonds mined from the earth. Diamonds manufactured in laboratories, which possess identical properties to natural diamonds, are frequently offered at a lower price. Other gemstones, such as moissanite or cubic zirconia, may also be used instead of diamonds. These choices offer the same beauty while being less expensive.

Q: How do ethical concerns, such as conflict diamonds, impact diamond prices?

A: The diamond industry has become more regulated and has garnered more attention due to ethical issues like conflict diamonds. While those in support of “conflict-free” diamonds assert that these regulations are necessary to ensure responsible sourcing, critics argue that such policies also drive up the price of diamonds. Regardless, these policies do offer some guarantees to consumers concerning the products that they are purchasing. This makes the cost of such diamonds justifiable as consumers know they are getting gems that have ethical sourcing.

Reference Sources

1. Predicting The Price Of Diamonds Using Regression Algorithms: Key Factors Analysis and Performance Evaluation

- Author: Minxi Xiao

- Publication Date: December 26, 2024

- Published In: Advances in Economics, Management, and Political Sciences

- Description of The Work:

- This research seeks to apply different approaches of machine learning to the problem of forecasting diamond prices in addition to discerning the critical factors contributing to pricing in the jewelry industry.

- The dataset consisted of 53940 records and 10 fields, and preprocessing for analysis was done by removing erroneous records and transforming categorical values to numerical ones.

- Different models were tried out including random forest, k-nearest neighbors, Extreme Gradient Boosting (XGBoost), and multilayer perceptron which were all regression based.

- The XGBoost model offered the best results with minimum Root Mean Square Error (RMSE), maximum accuracy, and R-squared values of 0.982129.

- The most important attributes determining diamond prices were carat, cut, color, and clarity.

- Approach Taken: This study combines regression techniques with machine learning, concentrating on evaluation metrics using cross-validation.

2. Research on Predicting the Price of Diamonds Using Multiple Regression Analysis, Decision Trees, and Random Forests

- Author: Zhe OuYang

- Publication Date: January 22, 2024

- Journal: Highlights in Business, Economics and Management

- Summary:

- This study employs Multiple Linear Regression, Decision Tree Regression, and Random Forest Regression models to estimate diamond prices within the context of a given set of evaluative metrics.

- According to this research, the best fitting and most predictive model for diamond price prediction was the Random Forest Regression model.

- This research seeks to assist consumers in understanding the price range of diamonds with respect to chosen evaluative criteria.

- Methodology: This study was conducted using regression models and aimed at estimating the price of diamonds in relation to their characteristics and predictive accuracy.

3. Machine Learning Models for Predictive Analysis and Feature Importance Assessment in Pricing Diamonds

- Author: Hairong Zhang

- Publication Date: December 1, 2023

- Journal: Advances in Economics, Management and Political Sciences

- Summary:

- This work analyzes the problem of predicting diamond prices based on numerous machine learning models and the importance of individual features in pricing diamonds.

- According to the research results, the best performance in the study was achieved by the XGBoost model which had the highest R square and the lowest RMSE out of all models applied.

- The study determined that carat weight had the most significant impact, with width coming second, and clarity and color following next.

- Methodology: The study employed a multivariate data analysis approach that examined the interrelationships among attributes of diamond pricing and utilized feature selection techniques to evaluate the most important features.

4. Diamond

5. Price

6. Jewellery

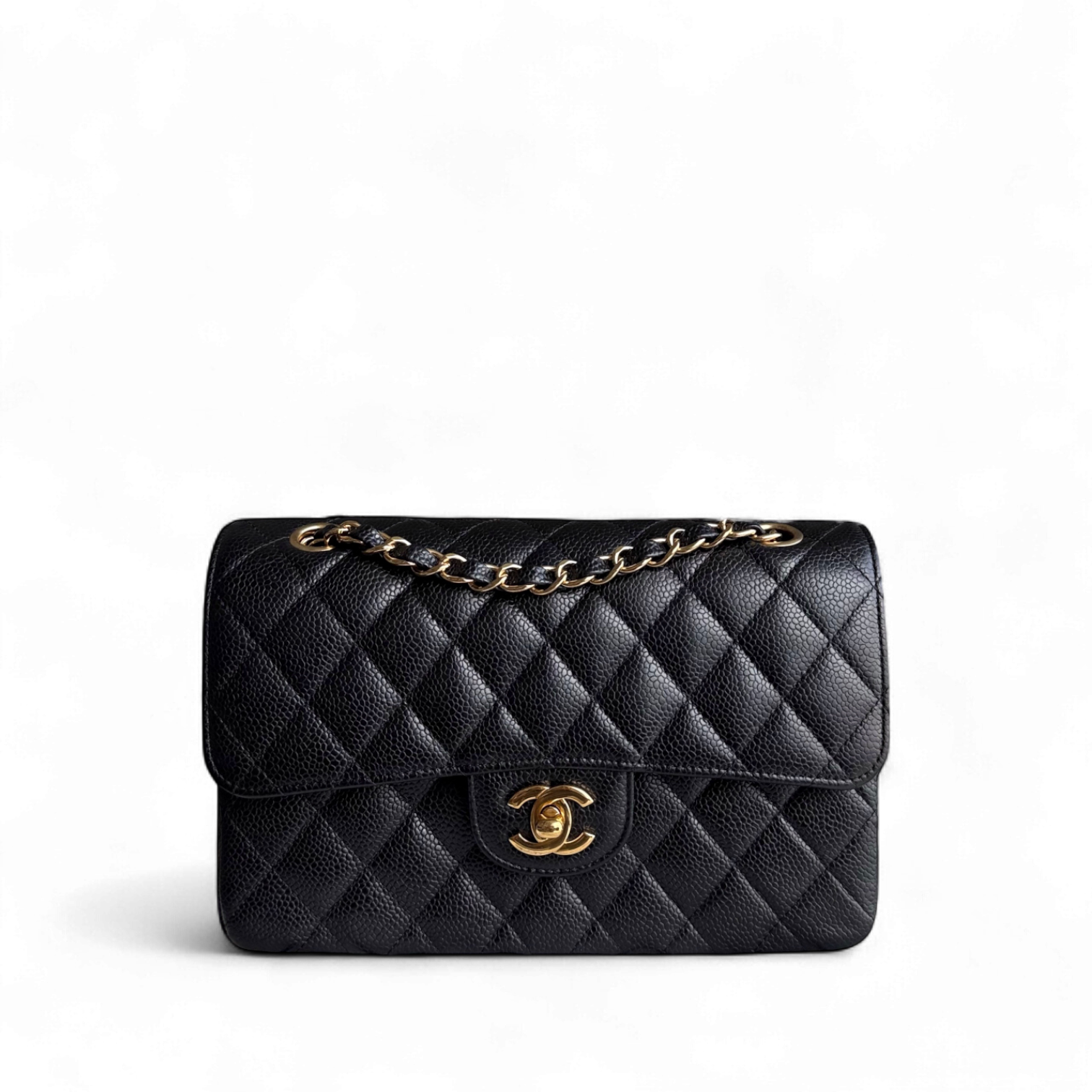

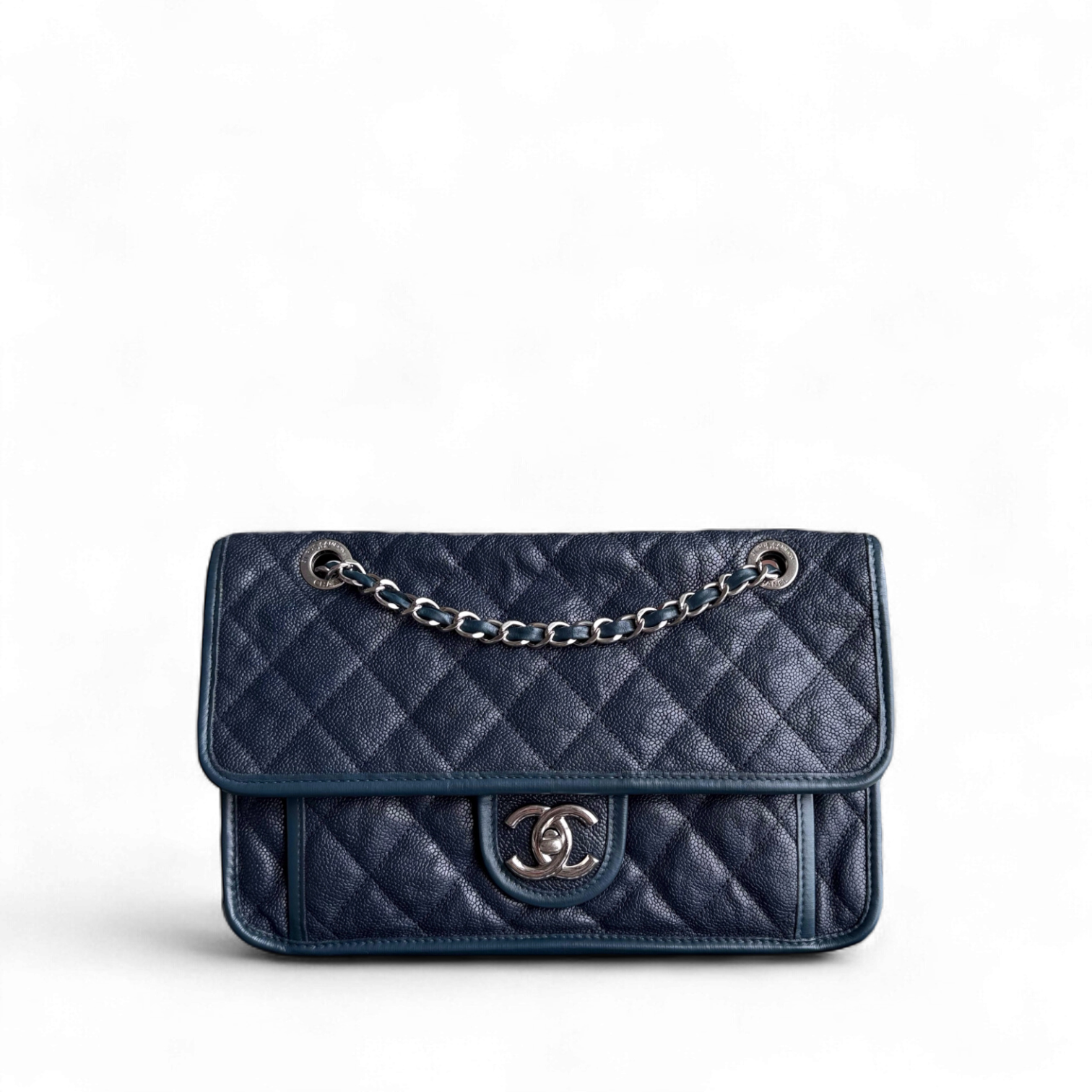

Contact Luxury Evermore should you need help with acquiring or building up your collection. There is a variety of brands with different styles, as well as sizes, and colors, for example, Hermes, Chanel, lv and Dior. If you are not lucky enough to find the bag you are looking for on our website then our concierge team will probably be able to order it for you. We provide 100% authenticity guarantee for all our bags, and any item sold on this site will be dispatched to you within one to two business days upon receipt of the payment.