Is 2025 the End of Mass Luxury? The Rise of Conscious Consumers

According to Fashion Network's data research, the luxury goods market saw a substantial slowdown in 2024, with big companies like LVMH and Kering reporting decreases in sales.

LVMH Revenue Decreases Slightly

Despite a minor decline in revenue, LVMH emerged as the relative winner of the luxury sector during difficult market conditions. But LVMH and Kering have such massive operations, even a tiny percentage decline in cash results in a significant absolute decrease.

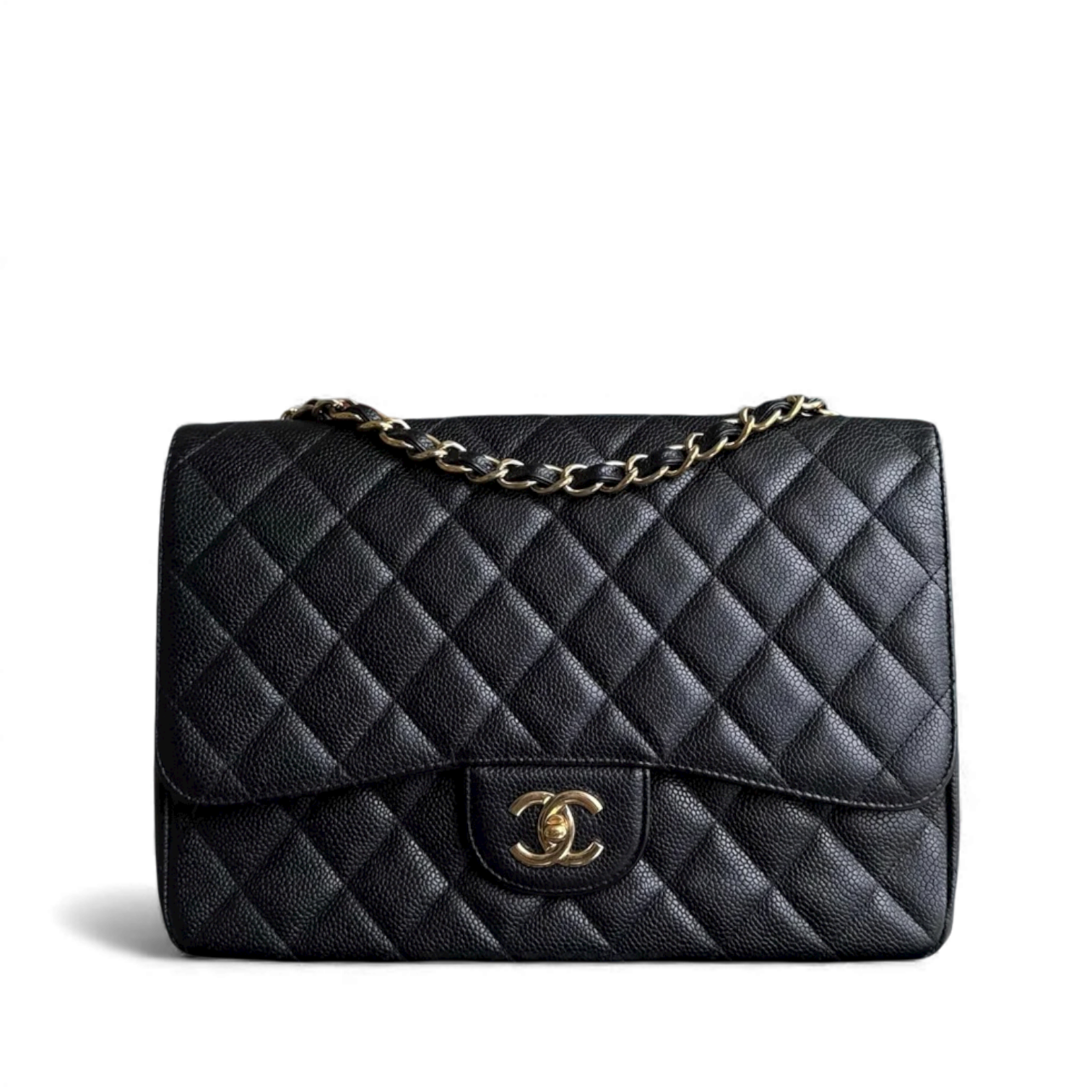

In 2024, LVMH generated an estimated 83.01 billion euros in revenue from its fashion and leather goods division, a slight decrease of 2 percent compared to the previous year. This drop in revenue is roughly equivalent to the sum of revenues for companies like SMCP, Capri Holdings Group (VFC, Versace, Jimmy Choo, and Michael Kors), or Compagnie Financière Richemont (excluding online retailers YOOX and The Hut.com).

Kering Sales Drop 12%, Hermès Continues Growth Streak

Kering too had a difficult year; according to Fashion Network data, its fashion and leather products segment saw a 12-percent decline in revenue, totaling 15.56 billion euros in 2024. The revenue produced by Compagnie Financière Richemont's leading brands, such as Cartier, Van Cleef & Arpels, and Watches of Switzerland, is approximately equal to this absolute decline.

Hermès, on the other hand, keeps up its upward trend, with its leather goods and saddlery sector generating close to 13.7 billion euros in 2024—a nearly 13 percent rise from the year before. This demonstrates the brand's tenacity, which

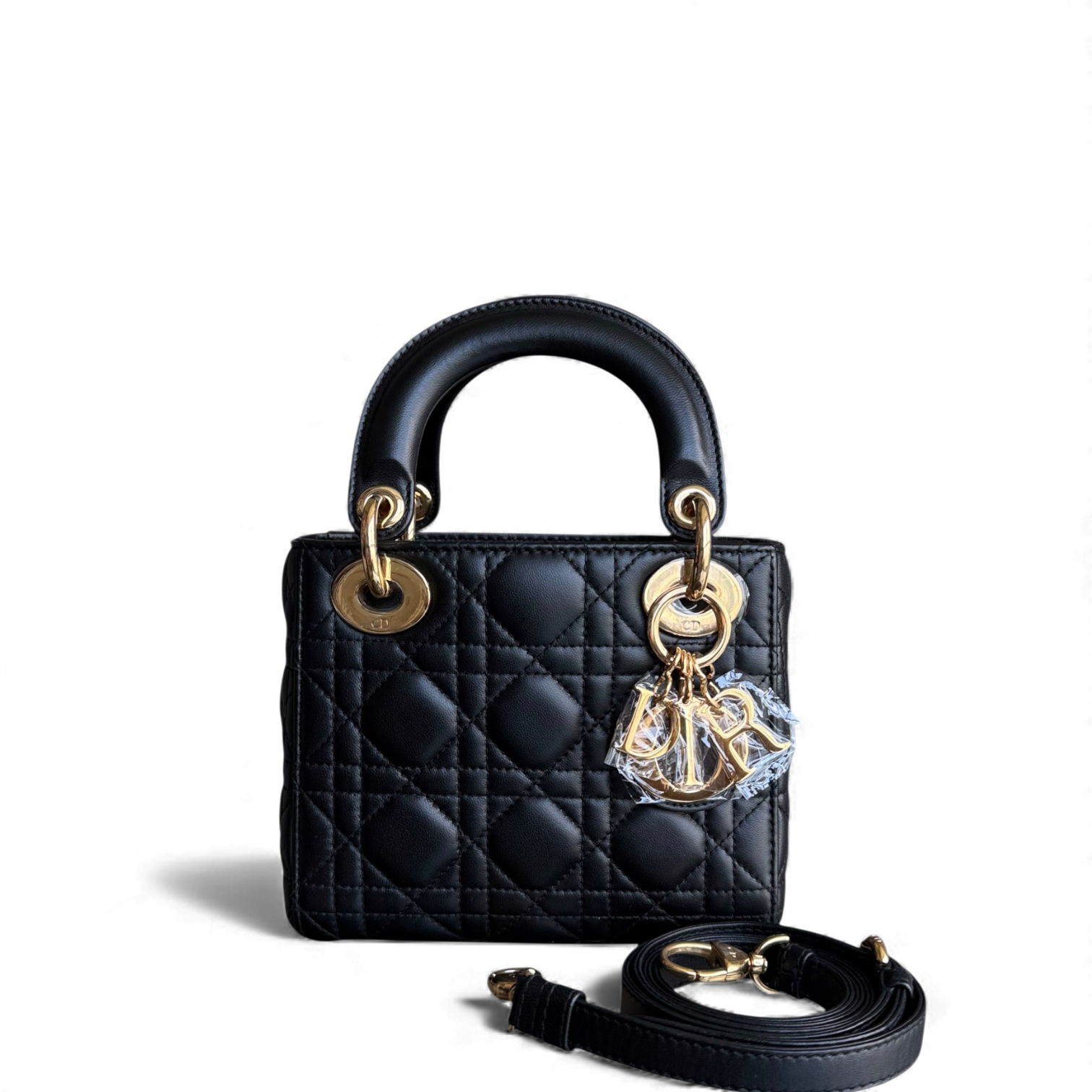

Dior and Gucci Faced Internal Challenges

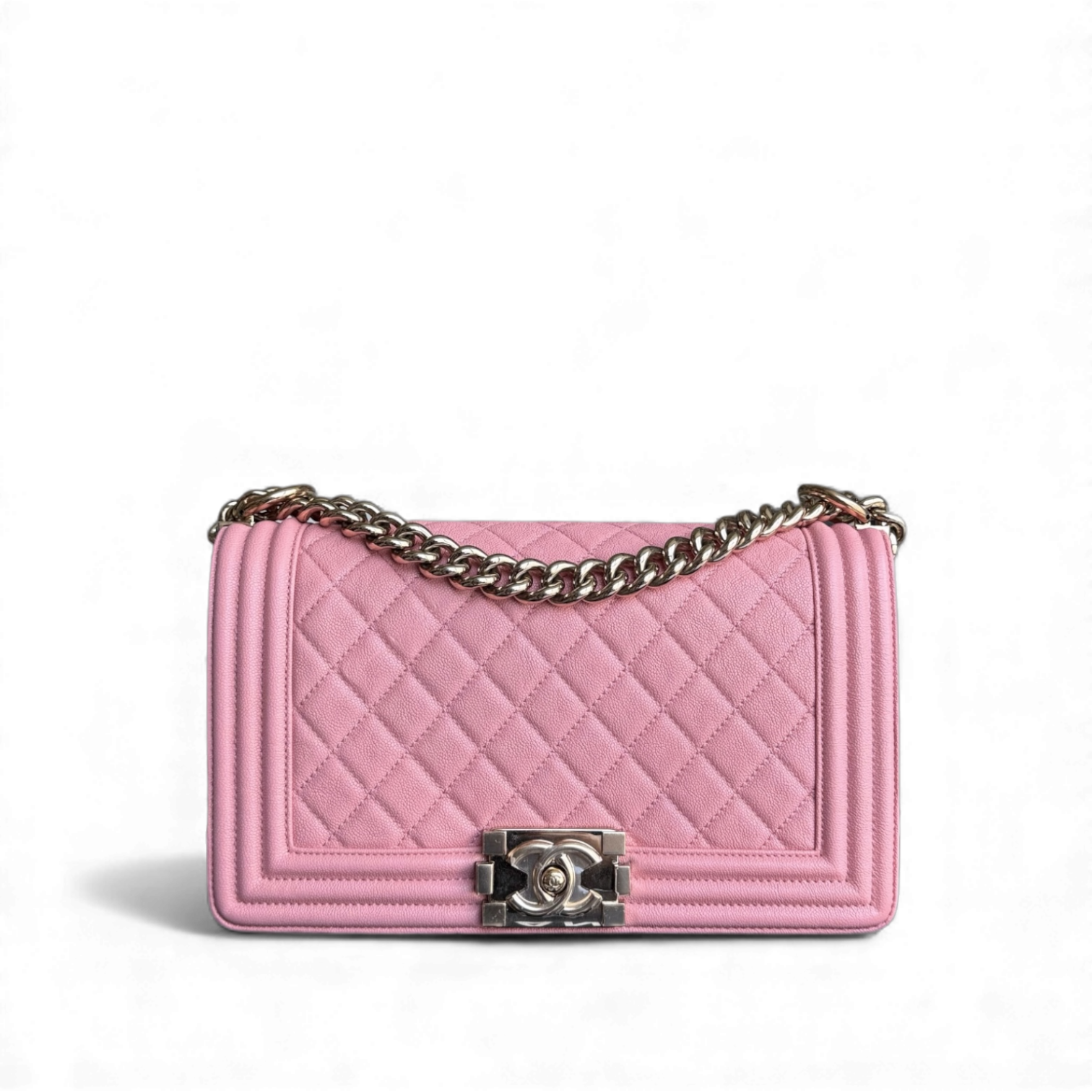

Dior, the dominant brand of LVMH, had a turbulent year that included declining sales, price hikes, and, in the end, the departure of creative director Maria Grazia Chiuri. 2024 demonstrated the potential drawbacks of Dior's reliance on the 30% of Chinese buyers that fuel its revenues.

In a similar vein, Kering's main brand, Gucci, saw a decline in sales and a change in leadership when Daniel Lee replaced Alessandro Michele as creative director. The brand's difficulties have been exacerbated by price increases and shifts in creative direction.

The Rise of Niche Luxury?

Smaller, independent luxury firms are apparently gaining traction by concentrating on specialized markets and providing highly personalized experiences, while major brands struggle with diminishing revenues. These companies appeal to a rising market of buyers looking for alternatives to mass-produced luxury items by emphasizing ethical sourcing, sustainable processes, and handcrafted excellence. According to industry experts, the luxury market's future may be altered by this move toward conscious consumption, which would put existing firms' hegemony in jeopardy.

What Advantages Help Indie Labels Compete?

78% of luxury shoppers now value craftsmanship over brand status, highlighting the tectonic shift in the luxury market and contributing to independent labels' 22% yearly increase while conglomerates' 4% drop. In sharp contrast to luxury behemoths that face 35% returns on mass-produced goods, artisanal firms, such as those covered in r/handbags, achieve 60–80% customer retention through made-to-order services and material transparency. This change in perspective is consistent with developments in the beauty businesses, where 63% of consumers now favor independent brands for ethical formulations.

| Metric | Major Brands | Indie Labels |

|---|---|---|

| Price Increase (2019-2025) | 49% (Chanel) | 12% avg |

| Customer Trust Score* | 58/100 | 89/100 |

| Sustainable Materials Use | 23% of lines | 78% of lines |

This realignment stems from fundamental value perception changes - 64% of luxury shoppers now consider artisanal brands "true luxury" versus 29% for conglomerates. The rise of platforms like Etsy's luxury segment (up 142% YoY) enables microbrands to compete through zero-waste production and blockchain-verified sourcing. As noted in r/femalefashionadvice, consumers increasingly reject "logo fatigue," with 61% willing to pay premium prices for unbranded excellence - a niche where independent makers dominate through technical innovation like 3D-printed leather alternatives and AI-powered custom tailoring.